Electric mobility has moved from futuristic concept to daily reality, and the pace of change is especially striking in India. Month-on-month Vahan data shows electric two-wheeler registrations leaping from 73,651 in December 2024 to 97,734 in January 2025, while four-wheelers climbed from 9,116 to 11,247 during the same period. This explosive growth signals a prime moment to step into an electric charging station franchise, turning the surge in vehicle demand into a reliable, long-term revenue stream.

Understanding exactly how the opportunity works, the capital required, and the practical hurdles involved will help you decide whether this is the right enterprise for your ambitions. The following guide walks through every critical aspect—finance, regulations, technology, site selection, and more—so you can launch and scale with confidence.

Understanding the EV Charging Station Franchise Opportunity

India’s drive toward cleaner transport is accelerating. Government incentives, rising fuel prices, and a public shift towards eco-conscious choices have combined to push electric vehicle (EV) adoption onto a steep upward curve. The government has set an ambitious 30 % EV penetration target by 2030, effectively guaranteeing sustained demand for charging infrastructure.

Because most EV owners cannot install high-capacity chargers at home, public charging points are essential. Yet infrastructure still lags behind vehicle sales, opening a lucrative gap in the market. By securing an electric charging station franchise you tap into:

- An escalating customer base: two-wheelers, fleet operators, ride-hailing services, and private car owners all need dependable charging on the go.

- Government support aimed at expanding the network quickly, from subsidies to simplified permissions.

- A technology-driven sector with room for service differentiation—speed, uptime, and digital convenience matter as much as location.

Entrepreneurs who move early position themselves as indispensable energy retailers in tomorrow’s mobility landscape.

Investment and Profitability

Launching an electric charging station franchise typically requires ₹1–2 crore. This figure covers site development, high-capacity chargers, civil and electrical work, grid upgrades, and initial fees to the franchisor. While the upfront figure may appear steep, the business model balances risk with multiple income streams and comparatively low running costs.

Revenue channels include:

- Direct charging fees: customers pay per kWh or per minute, often via mobile app.

- Fleet partnerships: ride-hailing firms and logistics operators need predictable bulk charging. Contracts secure steady utilisation.

- Advertising: digital screens and charger façades double as high-visibility ad real estate.

- Retail integration: cafés, convenience stores, or quick-service restaurants on-site boost dwell-time spending.

Operating costs stay far below those of conventional petrol pumps—no volatile fuel inventory and minimal staff overhead. Electricity tariffs are more stable, and smart load management further reduces wastage. With utilisation climbing alongside vehicle adoption, break-even can arrive faster than many other brick-and-mortar franchises.

Common pitfalls involve underestimating the capital tied up in power-infrastructure upgrades or overestimating early-stage footfall. Accurate projections and a diversified income plan help maintain healthy cash flow until usage hits full stride.

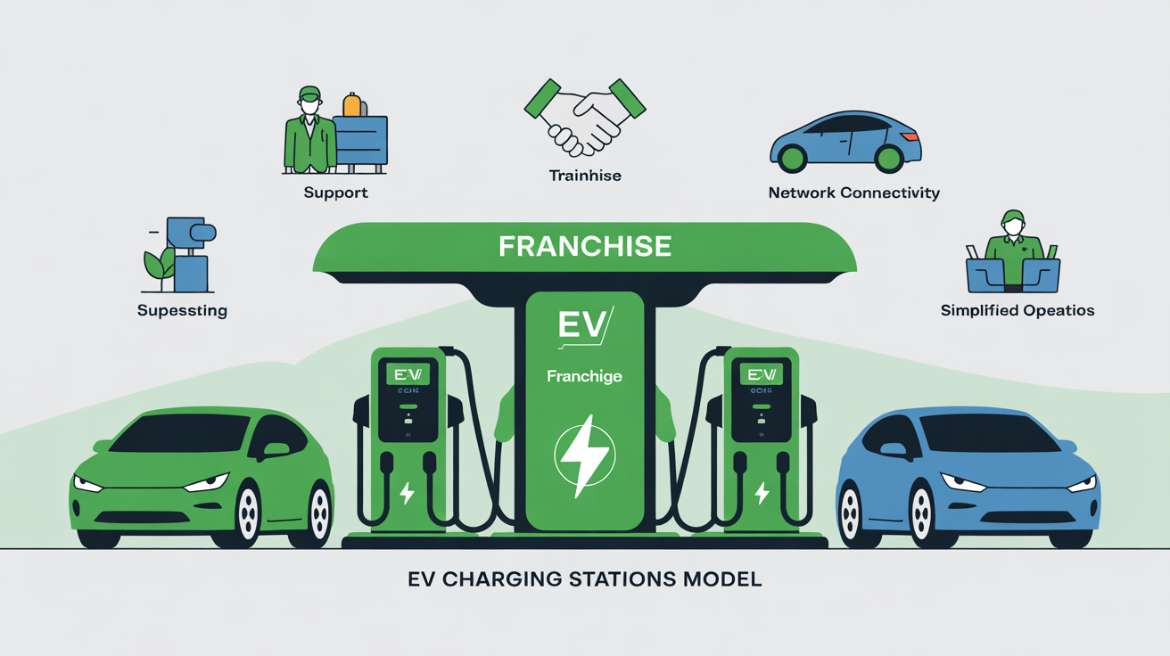

Franchise Model Benefits

Building a charging network from scratch entails complex engineering, software development, and ongoing maintenance. A proven electric charging station franchise removes those barriers:

- Hassle-free roll-out: the franchisor handles equipment sourcing, installation, and commissioning, delivering a turnkey facility.

- Site feasibility expertise: sophisticated tools predict traffic density, vehicle mix, and grid readiness, guiding you to profitable plots.

- 24/7 monitoring: advanced IoT sensors alert technicians to faults before customers notice, preserving uptime and brand reputation.

- Continuous upgrades: as battery technology evolves, franchisors push firmware and hardware updates, sparing you future cap-ex headaches.

- Marketing muscle: network-wide mobile apps direct drivers to your charger, while integrated payment gateways streamline transactions.

With these advantages you concentrate on daily operations, partnership building, and local customer engagement rather than technical firefighting. Several leading platforms—ThunderPlus included—also bundle training modules and performance dashboards so you can fine-tune utilisation in real time.

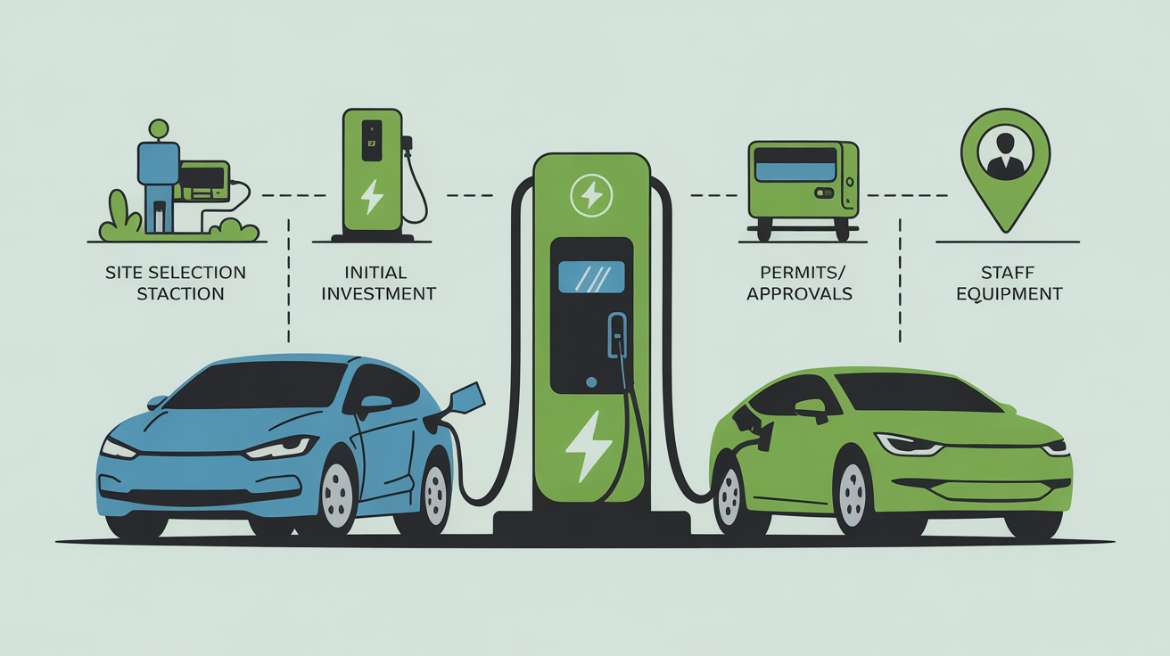

Key Requirements for Setting Up a Franchise

While plug-and-play support is comprehensive, success still hinges on meeting core prerequisites.

- Prime location

High-traffic corridors such as shopping malls, business parks, residential clusters, and highway rest areas outperform isolated plots. Easy ingress, ample parking bays, and visibility from the main road attract spontaneous users.

- Robust power supply

Multi-gun DC fast chargers draw significant load. Collaborate with the local distribution company early to confirm transformer capacity and secure dedicated metering. Backup arrangements (for example, on-site battery storage) mitigate voltage dips.

- Compliant equipment

Chargers must adhere to Indian safety and interoperability standards so every make of EV can connect. Franchisors usually pre-approve hardware, but you remain responsible for verifying certifications before purchase.

- Regulatory clearances

Even though no separate licence is required, municipal building permits, fire-safety approvals, and environmental assessments may apply. Start paperwork parallel to site preparation to avoid commissioning delays.

Ignoring any of the above can inflate timelines and costs. Conduct a thorough due-diligence checklist or partner with a consultant recommended by your franchisor.

Strategic Locations and Market Potential

Not all cities deliver equal returns. Tech-savvy, sustainability-minded urban centres provide fertile ground for a high-utilisation charging hub. Bangalore stands out: its dense IT belt, corporate fleet adoption, and municipal climate goals translate into a ready customer base. Similar dynamics are unfolding in Delhi-NCR, Hyderabad, Pune, and Chennai.

When shortlisting plots, overlay EV registration data, commuting patterns, and competing charger density. A location that serves both daily commuters and inter-city travellers maximises throughput. Think transport nodal points—ring roads, metro stations, and bus depots—where dwell time aligns perfectly with a 20-40-minute rapid top-up.

Market potential is only set to expand. As EV prices drop and model variety widens, utilisation of each installed charger naturally rises, amplifying revenue without further capital expenditure.

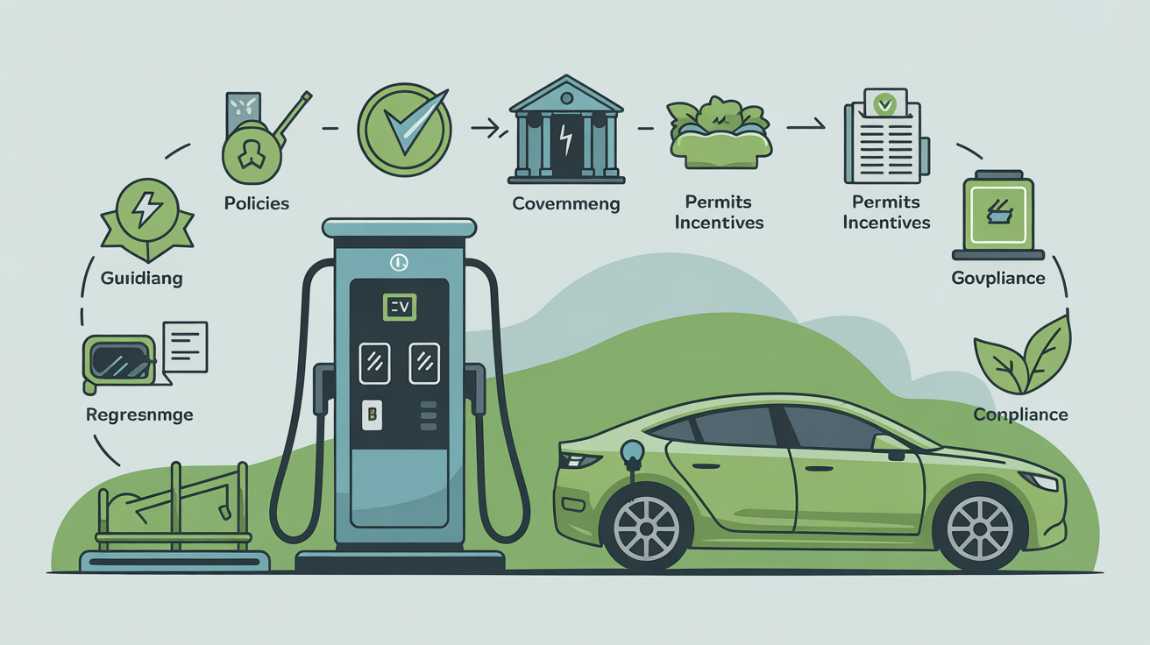

Government Support and Regulations

Policy momentum is firmly on the side of green mobility. Key regulatory highlights for your electric charging station franchise include:

- Open-licence regime: any individual or entity may set up public chargers without needing a separate petrol-pump-style dealership licence.

- Mandatory standards: chargers must comply with safety codes and offer interoperability across all major vehicle connectors.

- Incentives: central and state governments provide capital subsidies, tax rebates, and low-interest loans to accelerate infrastructure rollout.

- Network service provider partnerships: integration with recognised software back-ends ensures real-time data exchange, remote diagnostics, and compatibility with national roaming protocols.

Keep abreast of evolving guidelines; incentive caps and technical standards can change annually. Your franchisor’s policy team often supplies periodic compliance advice, saving you hours of bureaucratic legwork.

Challenges and Considerations

Every growing industry brings its share of hurdles. Awareness protects margins and reputation alike.

- Technology mix: Level 2 AC chargers cost less but deliver slower top-ups; DC fast chargers command bigger tariffs yet require stronger grid capacity. Align your hardware portfolio with local vehicle demographics and parking dwell times.

- Competitive differentiation: as networks proliferate, drivers will favour rapid, reliable, and user-friendly stations. Offer loyalty programmes, comfortable waiting lounges, or tie-ins with food outlets to stand out.

- Capital discipline: overspending on plush facilities before traffic justifies it strains returns. Phase expansion—start with core bays, then add chargers as utilisation builds.

- Long-term scalability: design civil works, cabling trenches, and power panels to accommodate future growth without major rework.

Viewing challenges through a growth lens reveals opportunity: every operational insight you gain today sets the foundation for a multi-site portfolio tomorrow.

Ready to be part of India’s next-gen EV charging revolution? Explore how ThunderPlus can help you launch your own electric charging station franchise and tap into diverse income streams—visit us at thunderplus.io to learn more!

Frequently Asked Questions

Q1. How to start an EV charging franchise?

Begin by selecting a reputable franchisor, secure a high-traffic site with dependable power, allocate ₹1–2 crore for setup, and complete local permits. Installation, software integration, and staff training follow before the station goes live.

Q2. How to get an EV charging station franchise in India?

Approach established charging-network companies, submit your site details for feasibility analysis, and review their franchise agreement covering costs, revenue share, and technical support. Once approved, you progress to civil works and equipment installation.

Q3. What is an electric charging station franchise?

It is a business arrangement where you, the franchisee, operate public EV chargers under a larger network’s brand, using their technology, support systems, and customer app while earning revenue from every charging session.

Q4. Which location offers the best early returns?

Cities like Bangalore with a strong tech workforce and clear sustainability targets tend to deliver higher utilisation quicker, especially around IT parks and highway entry-exit points.

Q5. How does an electric charging station franchise compare with a traditional fuel pump?

Running costs are markedly lower—no volatile fuel inventory or extensive safety staffing—and multiple income streams (fleet contracts, advertising, retail add-ons) diversify earnings beyond simple energy sales.

Q6. What if a charger stops working unexpectedly?

Franchisors provide 24/7 remote diagnostics; most faults are fixed via software reboot. For hardware issues, on-site technicians are dispatched under service-level agreements, minimising downtime and customer inconvenience.