Electric mobility in India is no longer a distant dream—it is an unfolding reality powered by thousands of plugs sprouting up across highways, residential complexes, shopping malls and fleet depots. For anyone weighing the prospect of running an EV charging franchise or integrating chargers into an existing business, the first question is naturally, “how many charging stations in India can my customers already rely on?” This guide answers that core query in depth, examines the policies underpinning the network, and highlights the opportunities you can leverage right now.

The Current State of EV Charging Stations in India

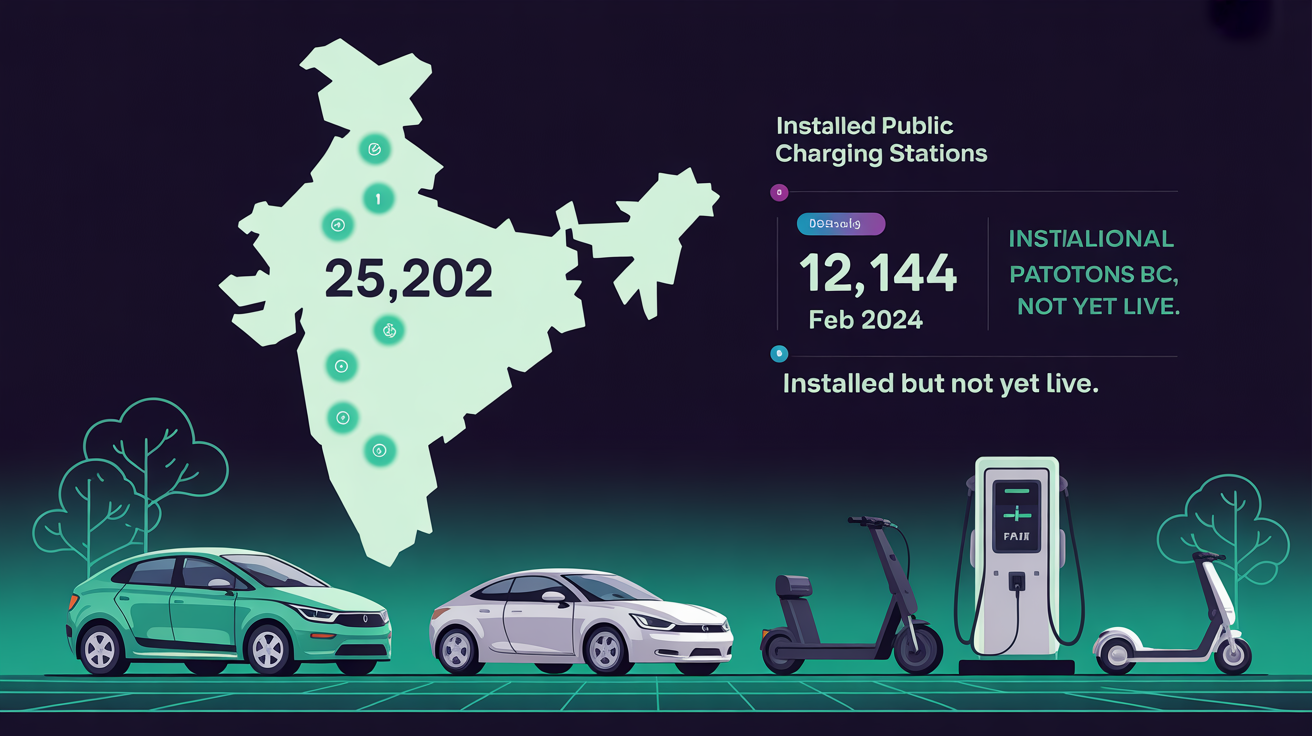

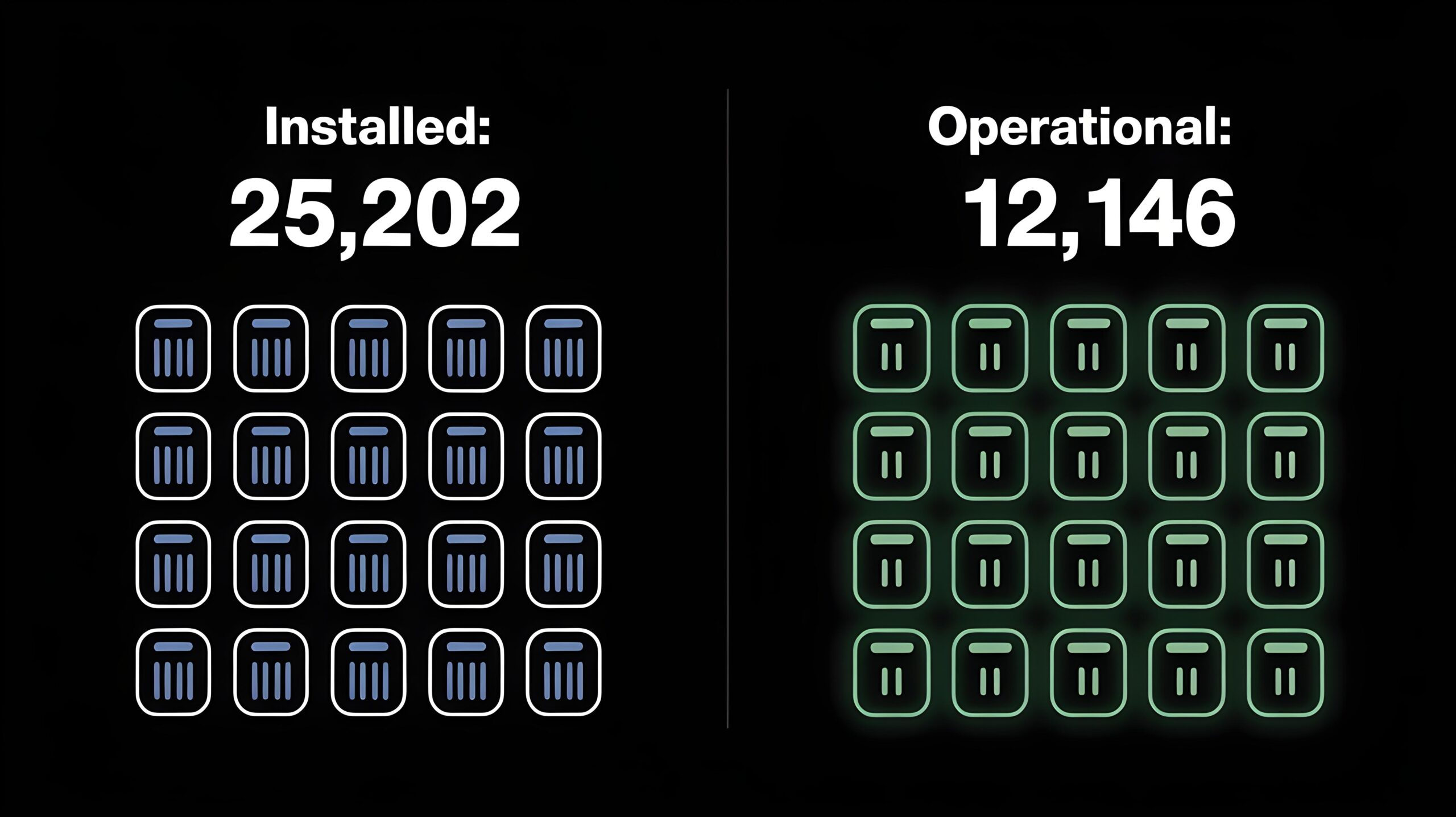

Before committing capital, you need a clear view of the marketplace. As of the latest figures released by the Ministry of Power, 25,202 Electric Vehicle Public Charging Stations (EVPCS) have been installed across the country. Of these, 12,146 public EV charging stations were confirmed operational on 2 February 2024. The difference between installed and operational numbers reflects a short commissioning lag plus a clutch of private, captive or yet-to-be-lit sites.

Drilling down, you find interesting regional stories. For instance, Chhattisgarh hosts 271 EVPCS, an impressive count for a state previously outside the usual EV spotlight. Metropolitan regions naturally cluster the bulk of chargers, but tier-2 and tier-3 cities are catching up fast thanks to government incentives and early-mover entrepreneurs.

Several industry players, including Thunderplus, have begun rolling out high-speed DC chargers at petrol pumps and convenience hubs, filling critical voids on long-distance corridors. In parallel, housing societies and office parks are installing AC points to meet daily workplace and home-overnight demand.

So, when someone asks how many charging stations in India today, the headline figure is 25,202 installations with more than twelve thousand already energised—and both numbers are climbing each week.

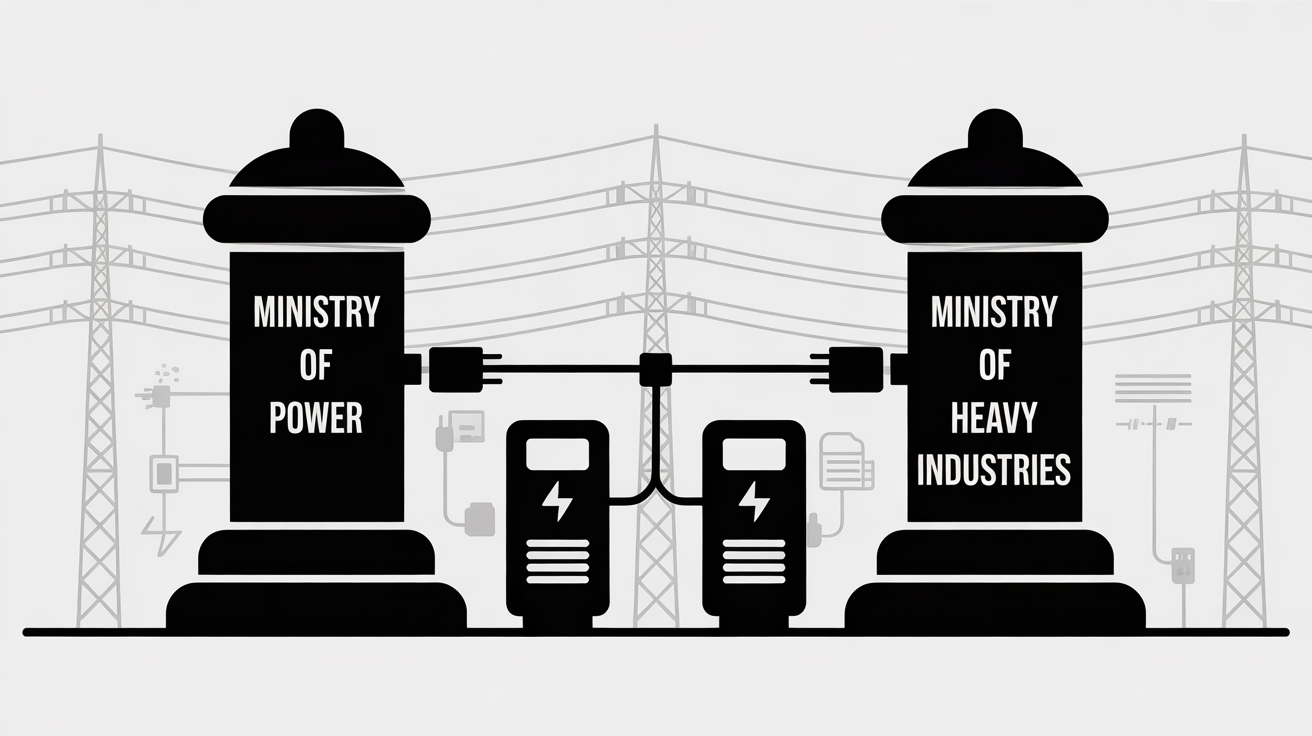

Key Ministries Driving the Numbers

Two central ministries propel this expansion:

- Ministry of Power (MoP) – custodian of grid readiness, tariff clarity and technical standards.

- Ministry of Heavy Industries (MHI) – steward of vehicle adoption schemes and capital subsidies for chargers.

Together, they ensure chargers are not just plentiful but also reliable, safe and interoperable.

Financial Muscle Behind the Roll-Out

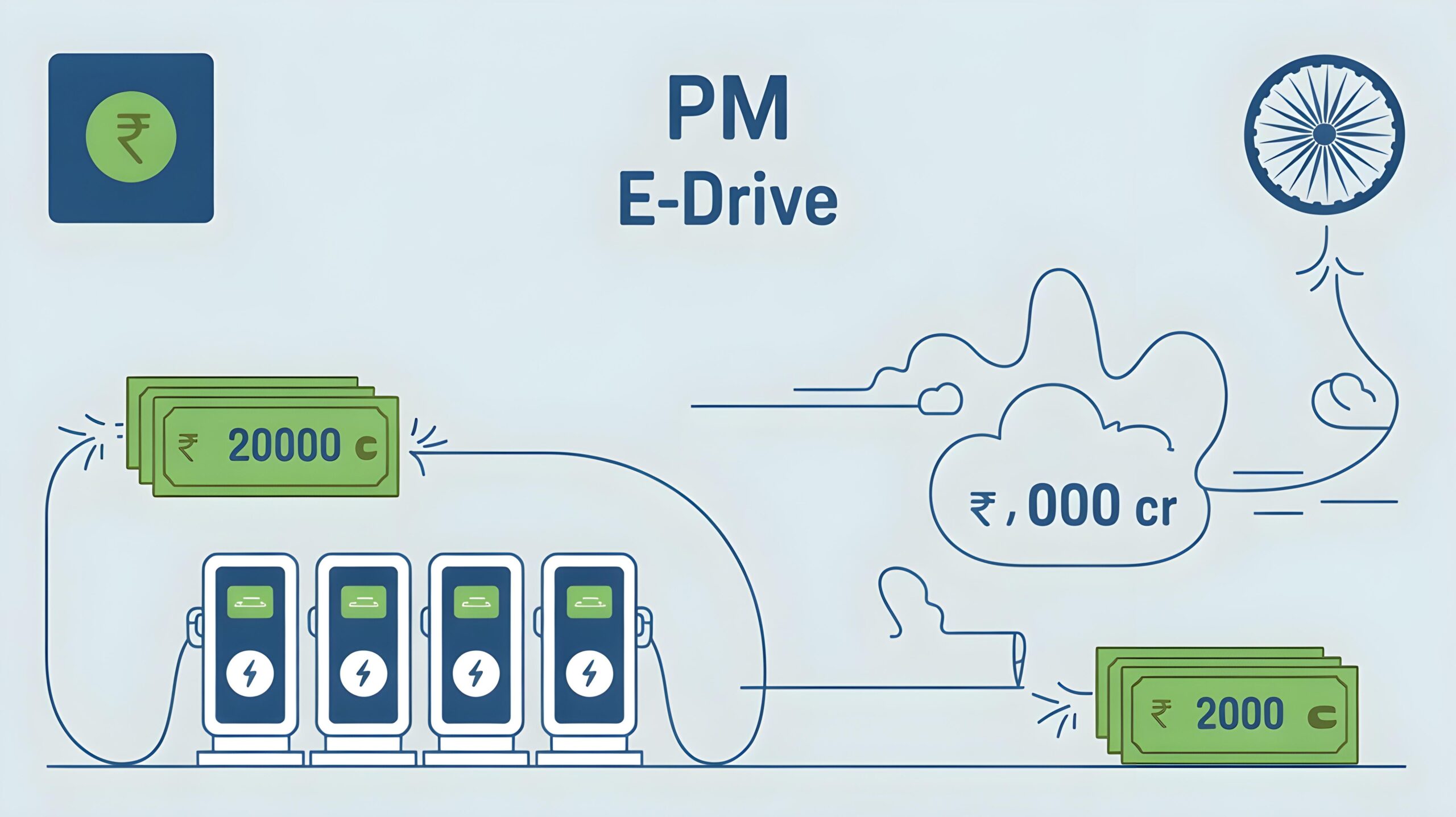

Policy without money stalls quickly; fortunately, funding is flowing. The newly notified PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme earmarks ₹10,900 crore over two years, ₹2,000 crore of which is reserved solely for public charging infrastructure. This money underwrites a wide variety of projects—from urban kerbside AC points to 240 kW highway DC monsters—lowering upfront risk for private investors like you.

Snapshot of Installed vs Operational Chargers

- Installed EVPCS (all categories): 25,202

- Operational public EVPCS (as of 2 Feb 2024): 12,146

The delta reveals significant growth runway; expect a substantial slice of the remaining 13,000-plus units to go live through 2025 as grid connections are finalised and last-mile civil works complete.

Government Initiatives and Guidelines That Matter to You

The recent policy blitz has produced a clear and investor-friendly roadmap. Skim through the highlights to understand where you can plug in—figuratively and literally.

Guidelines for Installation and Operation of EV Charging Infrastructure 2024

Released on 17 September 2024, these guidelines deliver:

- Nationally uniform technical standards (connectors, safety, metering)

- Interoperability mandates so any EV can charge at any public point

- Provisions for dynamic tariffs and open access to renewable energy

- Fast-track approval timelines in collaboration with state discoms and municipalities

The document’s clarity directly addresses a prior pain point—regulatory ambiguity—making it easier for start-ups and established energy companies alike to scale confidently.

FAME‐II and Its Legacy

Although FAME-II’s primary focus was vehicle subsidies, the scheme also subsidised public charging infrastructure to “instil confidence among EV users.” The early chargers funded under FAME-II became anchor sites, proving utilisation rates and unlocking private investment. Many existing franchise networks owe their pilot locations to this seed capital.

GO ELECTRIC Campaign

Launched in 2021, GO ELECTRIC raises consumer awareness about EVs and electric cooking. Higher awareness leads to more EV purchases, which in turn drives charger utilisation—a virtuous cycle strengthening the business case for new stations.

Factors Influencing Charging Infrastructure Density

You might be tempted to project future charger counts by simply mapping today’s EV registrations. Resist that urge; infrastructure demand is far more nuanced. The Ministry of Power points to at least five critical variables:

- Composition of EV fleet – two-wheelers, three-wheelers, cars, buses and freight each exhibit unique charging patterns.

- Running patterns – daily urban commutes vs unpredictable intercity logistics.

- Terrain and geography – mountainous regions need more waypoints due to energy drain on inclines.

- Urbanisation patterns – dense cities favour kerbside AC points, whereas suburbs lean on home charging.

- Technology evolution – battery chemistries, vehicle range and charger power levels shift optimal ratios.

Because these factors evolve continually, there is no global consensus on how many charging points are required per EV. Estimates stretch from 1 charger per 20 EVs to 1 per 150 EVs. Your business plan should therefore remain flexible, allowing for densification or redeployment as patterns crystallise.

Common Missteps and How to Avoid Them

- Ignoring utilisation data – installing a 240 kW charger in a locality dominated by two-wheelers invites low usage and high payback periods.

- Overlooking grid upgrade lead times – transformers and upstream feeders can take months to augment; plan early.

- Neglecting software interoperability – smart chargers without open protocols alienate roaming users and risk obsolescence.

Study MoP’s evolving standards and future-proof your network architecture. Thunderplus, for example, has adopted OCPP-based backend systems from day one, ensuring easy integration with new payment gateways and roaming partners.

Future Prospects and Expansion Plans Around the Corner

With policy clarity and money on the table, where is the network heading? Here is what official statements and budget lines indicate:

PM E-DRIVE’s Immediate Impact

- ₹2,000 crore for chargers is expected to subsidise thousands of additional EVPCS, especially in underserved semi-urban zones.

- The scheme favours cluster development, enabling high utilisation through dense placement rather than scattered solitary units.

- Funds also support indigenous manufacturing of chargers, potentially lowering equipment costs for franchisees.

Power Ministry’s Ongoing Push

Beyond guidelines, the MoP is facilitating:

- Green Energy Open Access Rules 2022 – allowing charge-point operators to procure renewable power directly, cutting operating costs and boosting green branding.

- A streamlined approval mechanism for private landowners to host chargers, eliminating multi-agency bottlenecks.

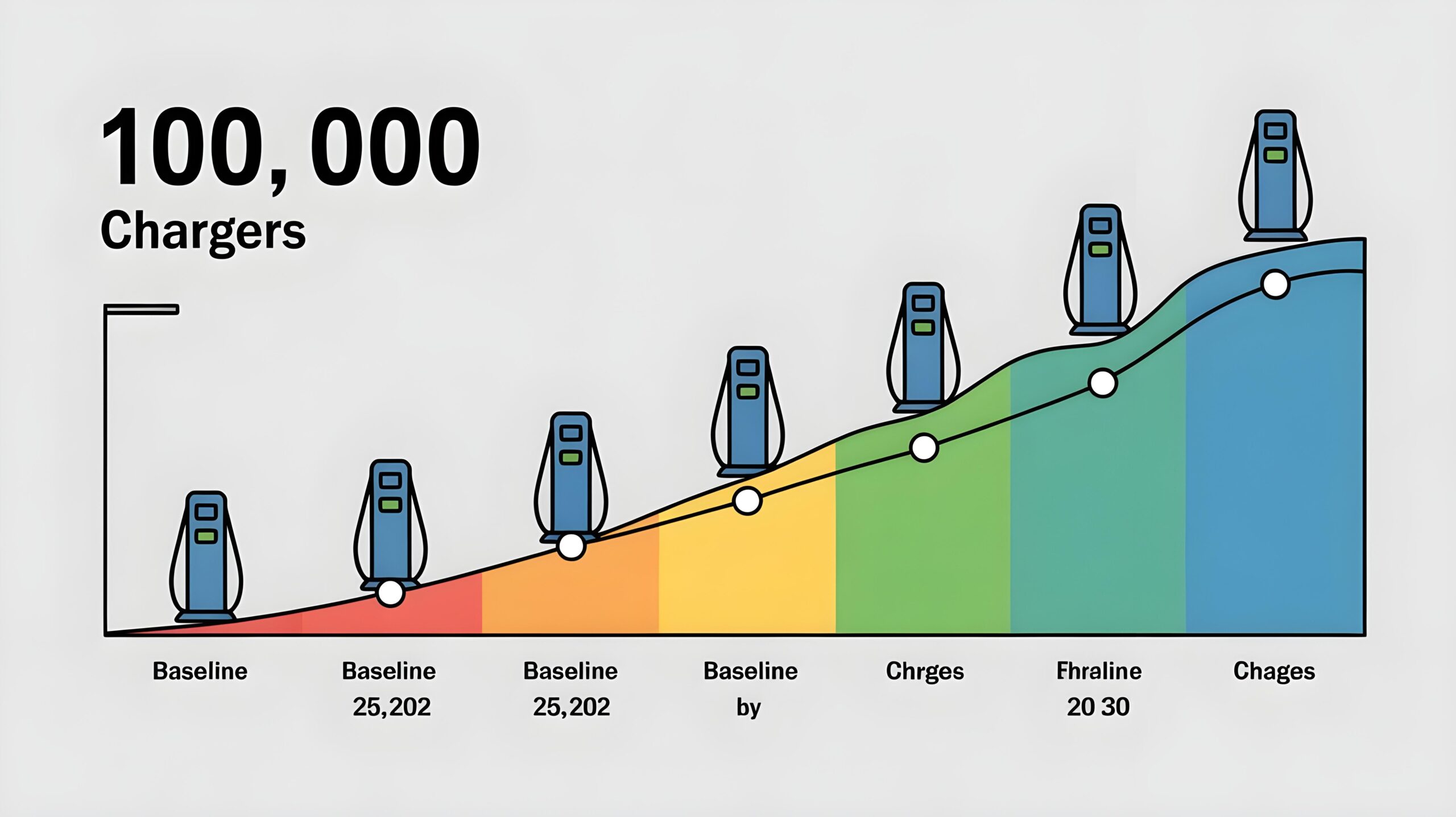

Numerical Outlook

Although no official cap has been set, internal discussions within NITI Aayog suggest that India may need between 80,000 and 100,000 public chargers by 2030 to support mass adoption targets. Given the current base of 25,202 installations, the market essentially has to triple or quadruple within six years—a massive opportunity for first movers.

What This Means for Your Business

- Fast roll-out beats perfection – secure prime locations now while subsidies and visibility are high.

- Diversify charger types – blend lower-cost AC points for day parking with high-margin DC units on highways.

- Collaborate with fleet operators – predictable utilisation from taxi or delivery partners accelerates breakeven.

Practical Steps to Enter the Charging Space Now

- Conduct a micro-market study – look at existing EV density, competitor chargers, grid capacity and land costs within a 5 km radius.

- Engage local discom early – a letter of intent can shave weeks off transformer upgrades.

- Draft a flexible CAPEX plan – allocate resources to modular charger cabinets that accept power module upgrades.

- Leverage PM E-DRIVE subsidies – prepare documentation in line with MoP guidelines; approvals now flow faster than ever.

- Build a strong service layer – a slick app, 24/7 customer helpline and predictive maintenance improve station loyalty and utilisation.

The Road Ahead

When you are asked how many charging stations in India exist today, you can confidently answer: 25,202 installed, with 12,146 already humming. More importantly, you now know why those numbers will grow and how government policy, market forces and technological advances intertwine.

India sits at the cusp of an electrified transport revolution. Whether you run a hospitality chain, a fuel retail business, a mall, or an independent start-up, you have a unique chance to shape the charging landscape while securing valuable new revenue streams. Keep a finger on policy updates, anticipate user behaviour shifts and act decisively. The plugs you install today could power both vehicles and profits for the next decade.

Ready to enhance your EV charging station’s performance? Explore ThunderPlus’s franchise models and individual units tailored for maximum ROI at thunderplus.io.

Frequently Asked Questions

Q1. How many charging stations in India are currently installed?

The latest Ministry of Power data puts the installed count at 25,202 Electric Vehicle Public Charging Stations across India.

Q2. How many EV charging stations in India are actually operational?

As of 2 February 2024, 12,146 public charging stations were confirmed operational and open for use.

Q3. How many electric charging stations in India are located in Chhattisgarh?

Chhattisgarh reports 271 installed EVPCS, reflecting targeted growth outside the usual metro hubs.

Q4. What practical first step should I take before investing in a charging station?

Begin with a micro-market study covering EV density, grid availability and competing chargers within a 5 km radius to validate demand and site viability.

Q5. How do AC chargers compare with DC chargers in terms of benefits?

AC chargers cost less to install and suit long-dwell locations like offices, while DC fast chargers deliver higher revenue per plug at highway stops by topping up cars in minutes.

Q6. My station shows low utilisation during the day—what advanced fix can I try?

Integrate fleet charging contracts or dynamic pricing in off-peak hours to boost throughput; software-driven load balancing can also help attract multiple users simultaneously.